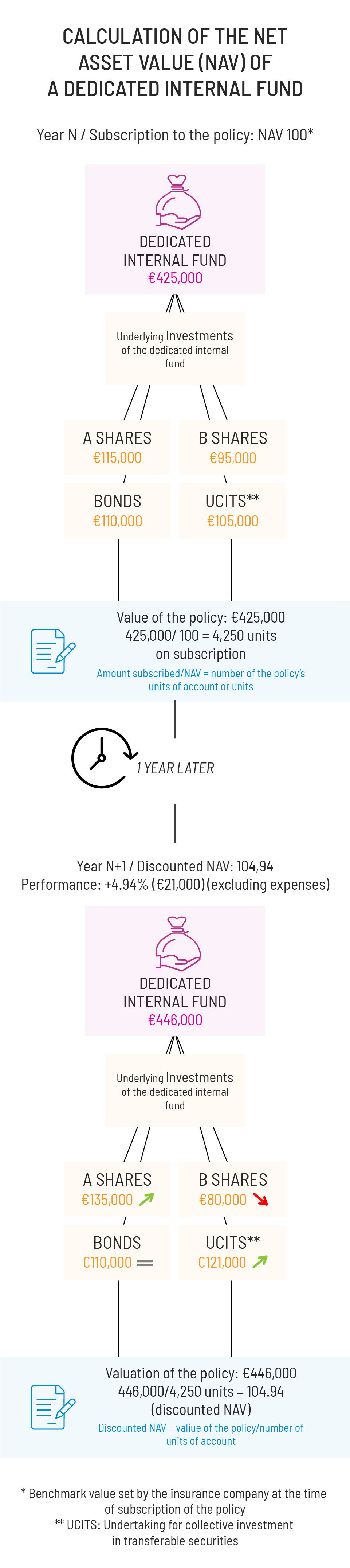

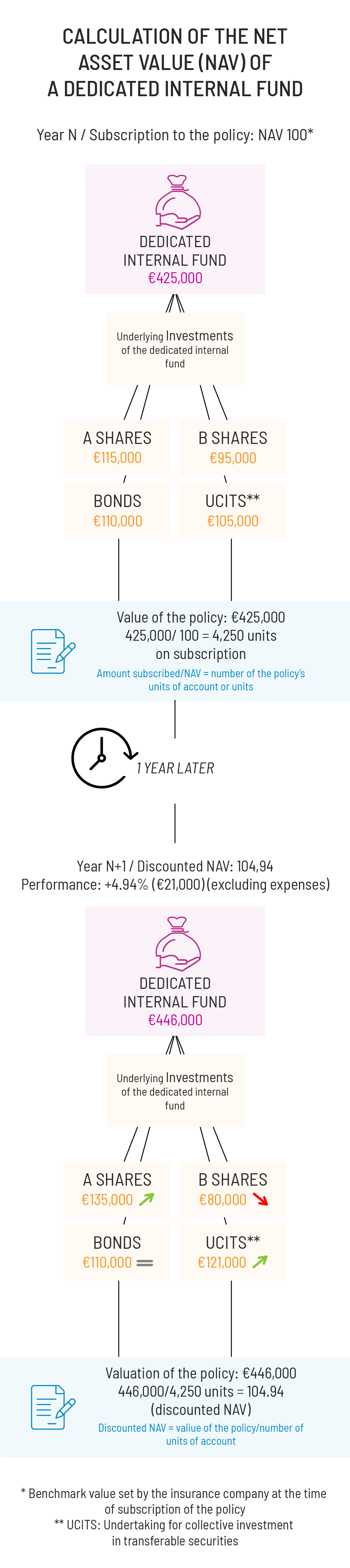

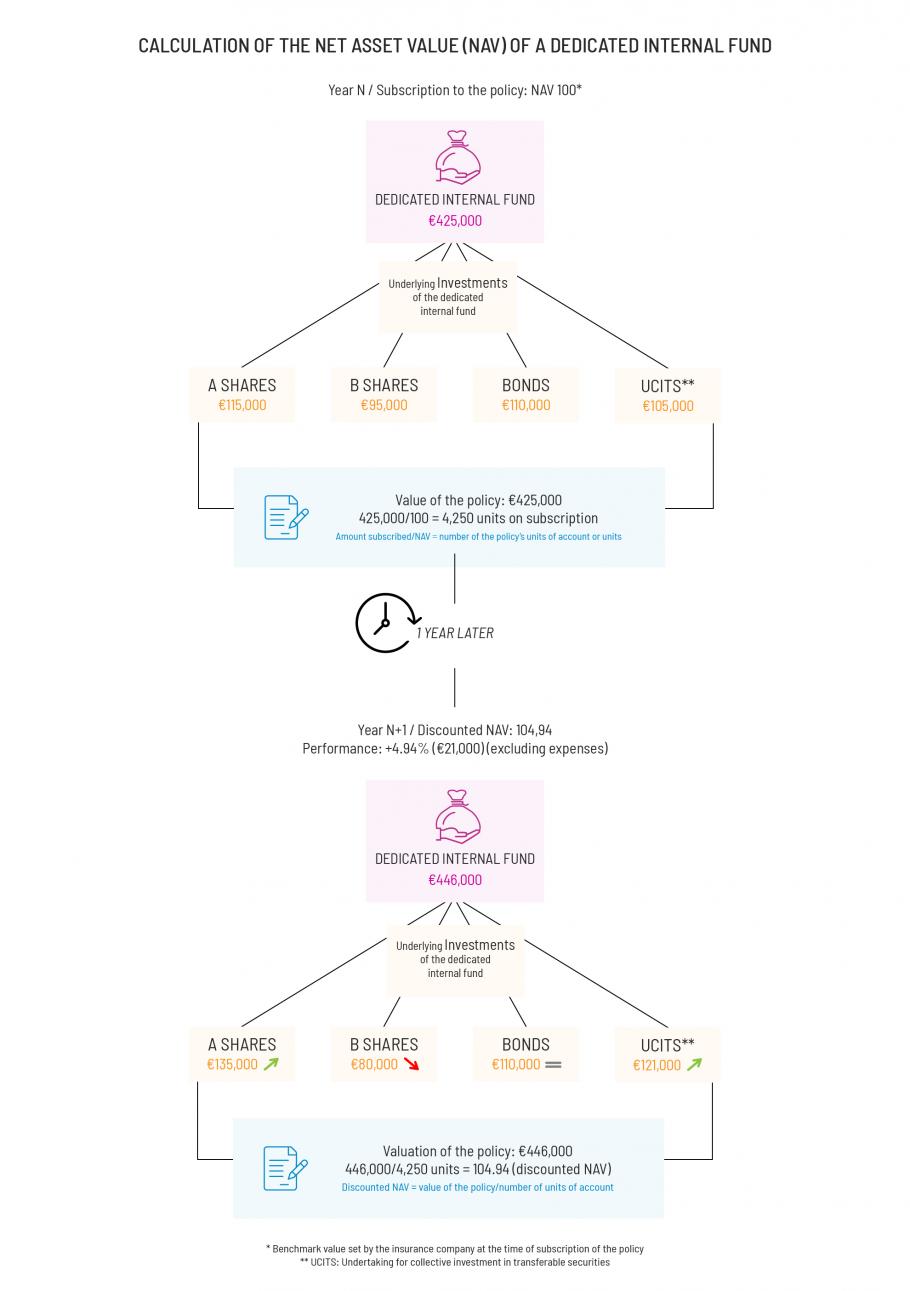

Calculation of the NAV of an internal dedicated fund

By

Reading time: 2 min

Do you wish to have more information?

Contact us

The contents of this theme

Calculate the NAV of a dedicated fund.

A dedicated fund is an underlying eligible within a Luxembourg life insurance contract. It is a fund that is used as a support for only one contract and whose management is delegated to an external professional manager. The internal dedicated fund invests in several underlying funds. In order to obtain the NAV of the dedicated fund, the amount subscribed to must be divided by the NAV set at the outset in order to obtain the initial number of shares in the contract. The NAV then discounted corresponds to the value of the contract divided by the number of units.