Case Study: Portability France - Italy

By

Reading time: < 5 minutes

How can a life insurance policy be used to plan for expatriation and to provide a global solution for wealth planning which not only ensures additional income but also prepares for the transfer of these assets to the next generation? Find out in this case study.

Do you wish to have more information?

Contact us

The contents of this theme

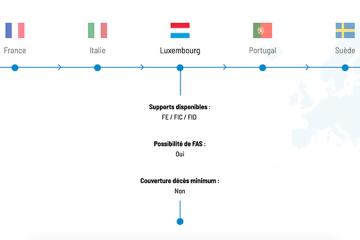

Use of the Luxembourg life insurance policy in a France-Italy expatriation.

One can use a Luxembourg life insurance contract in the context of an expatriation in order to have a global solution for wealth planning but also to have additional income and to prepare its transmission to the next generation.