The fundamentals of life insurance

The advantages of a unit-linked life insurance policy

Why choose a life insurance policy? What are the advantages?

How a life insurance policy works

Life insurance policy / Trust / Foundation: the comparative

History of life insurance in Europe

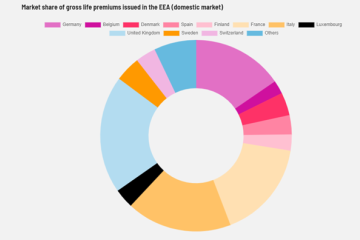

European statistics on life insurance

Life insurance in all its forms is today an essential asset management tool.

Indeed, in 2016 more than EUR 695.55 billion in gross premiums were collected in the European Economic Area.

Discover how this popular policy works.

History and origins of insurance

Insurance originated and was developed during Middle Age, when 14th century merchants traveled from one place of business to another. The first insurance policies concerned the maritime sector. Life insurance as we know it today has developed more recently, on the basis of marine insurance and fire insurance, and took off in European countries only in the 19th century under the pressure of industrialization, socialization and the desire to improve society.

In this first chapter we will be deciphering the fundamentals of life insurance and defining its bases.

Life insurance: how does it work?

But then, what exactly is a life insurance policy, and how does it work? To propose a simple definition of life insurance: it is a contractual relationship which involves several parties: the insurer, the policyholder, the life assured and the beneficiary. Functioning of life insurance is based on exchanges between these parties. The policyholder pays a premium to the insurer; in return, the latter undertakes to pay to the beneficiary(ies) the insurance benefit provided for in the policy at the time when the insured event occurs (termination of the policy or death of the insured).

Types of insurance

There are different types of insurance policy, depending on the risk insured and the insurance service provided by the insurer. Each type of insurance will operate in different circumstances.

We will therefore distinguish between insurance in the event of death, insurance in the event of survival, and mixed insurance.

A life insurance policy has the characteristics of "forward planning" and "protection" for oneself or to one’s close relations and it is an effective wealth and estate planning tool which differs from other known arrangements such as a foundation or a trust.

Benefits of life insurance

Life insurance policy is a powerful and flexible asset management tool since, while delivering the objective of protection and transmission, it may also benefit from certain inheritance advantages, depending on the subscriber’s country of residence.

Finally, it should not be forgotten that life insurance policies are considered to be instruments with characteristics which, as we shall see throughout this White Paper, are recognised at the international and European Community level, and this encourages their transnational mobility.

If you want to understand how a life insurance policy works in all its details, please download the white paper above.

Life insurance is a contractual relationship involving several parties: insurer, policyholder, insured and beneficiary(ies). The policyholder pays a premium to the insurer, in return, the latter undertakes to pay to the beneficiary(ies) the insurance benefit provided for in the policy at the time when the insured event occurs (termination of the policy or death of the insured). The insurance has many advantages which depend on the country of residence of the subscriber. A life insurance contract is also an excellent wealth planning tool.