The Freedom to Provide Services

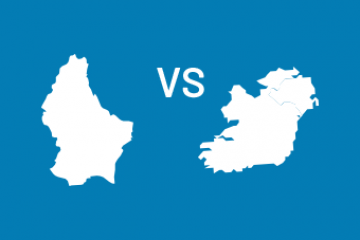

A comparison of financial centres: Luxembourg and Ireland

Does the Luxembourg life insurance policy really exist ?

How has Luxembourg become the leader in cross-border life insurance?

Case Study Mobility

How did Luxembourg win the race to attract High Net Worth Individuals (HNWI)?

Luxembourg is a true financial ecosystem for HNWI clients, notably thanks to the Freedom to Provide Services.

Introduced by the Third European Life Directive in effect since July 1st 1994, the Freedom to Provide Services (FPS) scheme grants all approved insurance companies established in a Member State of the European Union (EU) the benefit of a European passport. The objective: enabling them to conduct their business in all the other countries of the EU without having to be established there physically.

From the Treaty of Rome to Home Country Control, the evolution of the Freedom to Provide Services

The legal origins of the Freedom to Provide Services (FPS) can be found in the Treaty on the Functioning of the European Union - more generally known as the Treaty of Rome - signed on March 25th 1957, which established the European Economic Community (EEC).

The various European directives which followed this treaty and, in particular, the Third Life Directive, also established the principle of Home Country Control under which the financial supervision of insurance companies is conducted solely and exclusively by the supervisory authority of its home Member State of origin.

It is also the home Member State which draws up the prudential rules applicable to insurance policies.

Law applicable to insurance policies contract and its advantages

On the contractual side, however, the law applicable to the insurance policies is the law of the State of residence of the policyholder.

Thus, a Luxembourg life insurance policy subscribed by a resident of a Member State of the European Union enables him to benefit from advantages such as:

- the protection of assets;

- access to a broad class of underlying assets, to diversify his assets more widely and to tailor his policy to match his needs;

- access to the various Luxembourg unit-linked products, which are specific to Luxembourg prudential law;

- the ability to move to another Member State while keeping his insurance policy and adapting it to the legislation of his new State of residence (the so-called “portability” of the insurance policy) while benefiting from the tax neutrality of Luxembourg.

Luxembourg, a veritable financial ecosystem which encourages the Freedom to Provide Services for High Net Worth Individuals customers (HNWI)

The Freedom to Provide Services is therefore born of the European Union's desire to create a single European market for insurance.

Many Luxembourg insurance companies have chosen to opt for this scheme. Proof of the success of this method of marketing: the evolution of premiums from 2.3 billion in 1995 to 21,62 billion in 2018*.

Luxembourg has thus become a real centre of expertise for life insurance in the Freedom to Provide Services. It is the leading financial centre in the eurozone and also seems to be the choice of many companies wanting to relocate following the fallout from Brexit.

In recent years Luxembourg has developed a veritable financial ecosystem in which private banks, fund managers, financial sector professionals (lawyers, audit and consultancy firms, stock exchanges, financial institutions) and insurers work together to offer cutting-edge financial solutions to high net worth customers.

Luxembourg is not alone in benefitting from this directive since Ireland has also become a financial centre from which many insurance companies conduct their business under the Freedom to Provide Services.

If you want to know more about the Freedom to Provide Services, please download the white paper above.

* Sources: www.aca.lu – Key figures 2018, https://www.aca.lu/media/5c948906c5f36_key_figures_2018.pdf

La Libre Prestation de Services (LPS), effective depuis 1994, a permis à de nombreuses compagnies d'assurance-vie d'exercer leur activité dans d'autres pays de l'Union européenne sans devoir s'y installer. Cela permet au souscripteur d'un contrat d'assurance-vie de bénéficier des règles prudentielles du Luxembourg (triangle de sécurité, large classe d'actifs, portabilité du contrat) tout en sachant que le contrat est soumis aux règles contractuelles de son pays de résidence. Ce régime a incité de nombreuses companies d'assurance-vie à venir s'installer à Luxembourg qui est devenu un véritable centre de compétence financier.