International mobility and portability of life insurance policies

Case Study: Portability France - Italy

Portability of a policy from France to Portugal

Life insurance in a Franco-Belgian context

A world on the move: statistics on world and European mobility

Portability of the life insurance contract: what characteristics needs to be adapted when relocating?

Impact of cross-border mobility on the life-insurance contract portability.

In 2019, according to United Nations Statistics, 272 million people lived in countries where they were not born. International families are multiplying and are facing cross-border legal issues.

PORTABILITY OF THE LIFE INSURANCE CONTRACT: ORIGIN OF, AND CHANGES TO, THE PRINCIPLE OF FREE MOVEMENT

Europe through various treaties (Treaty of Rome, 1957; Treaty of Lisbon 1992, Schengen area agreement in 1995...) allowed the European citizens to move freely among the European Member states.

The free movement of persons is now firmly established in mentalities and organisations have been set up to facilitate such moves. When relocating, however, it is not possible to rule out the application of each State's national rules, which may differ and may make the subject of mobility complex.

LIFE INSURANCE POLICIES: IMPACT OF CROSS-BORDER MOBILITY ON CONTRACT PORTABILITY

In the context of a life insurance contract, portability of the contract is referred to if the place of habitual and/or tax residence of the policyholder changes.

The mobility of the policyholder will have different consequences on the portability of the life insurance policy.

The contractual consequences of the portability of the life insurance contract

If the policyholder relocates, the obligatory rules of his new country of residence must be applied and implemented for his policy. They may affect:

- the composition of the policy (e.g. mandatory death coverage in certain countries);

- the underlying investments (all types of investments, e.g. the Specialised Insurance Fund is not available in all countries).

It is therefore fundamental to get in touch with the insurance company and its advisor in order to plan the expatriation in advance.

Civil and tax consequences of the life insurance contract portability

Depending on the country of destination, there may be tax consequences for the tax treatment of the contract (surrender, tax declaration) and the payment of the benefit to the beneficiary.

With regard to the outcome of the contract, particular attention must be paid to the civil law applicable to the inheritance.

The advantages of a life insurance policy taken out in Luxembourg with regard to portability

Luxembourg is recognised as a stable and innovative financial centre in the European Union, with unique cross-border expertise.

In addition to the fact that the investment funds market is constantly growing, the various advantages offered by Luxembourg make life insurance policies a must:

- Investor protection in the event of bankruptcy;

- Use of the policy to protect the assets;

- Tax neutrality;

- Confidentiality;

- Diversity of management;

- Portability of the policy;

- Clear and flexible estate planning tailored to each client's needs;

- Investment strategy tailored to the client.

THE PORTABILITY OF THE LIFE INSURANCE CONTRACT: INTERESTING FLEXIBILITY

The Luxembourg life insurance policy continues to demonstrate its flexibility, since it can, with various amendments, follow the policyholder wherever he chooses to live. Thanks to its portability, the Luxembourg policy is an excellent wealth planning tool for the management of mobile or dispersed wealth, provided that the insurance company is warned and informed so it can make the necessary adjustments prior to any move.

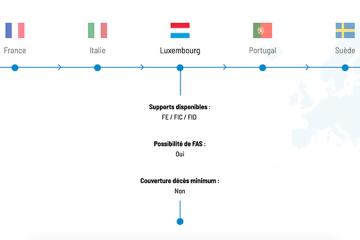

The portability of the Luxembourg life insurance contract is referred to if the policyholder's place of residence changes. In this case and under certain conditions, the life insurance contract can accompany the policyholer in his move provided that attention is paid to the composition of the contract and the underlying assets.