What roles do the accepting beneficiary and the irrevocable beneficiary have when there is a guarantee on the policy?

Life insurance can be used as a useful and effective instrument of wealth planning, since it makes it possible to organise the transfer of assets on a given date, or on the death of the owner, in an orderly transfer of assets, with favourable tax treatment and protection from future creditors, and exemption from the rules governing inheritance. Note that this must obviously be planned in such a way as to preserve the rights of third parties.

Among the significant advantages of life insurance as a wealth planning tool, the laws of most European countries enable policyholders to adjust the flexibility of wealth planning depending on the method chosen when nominating the beneficiary.

Accepting beneficiary: definition

Thus, as a general rule - and without going into the peculiarities and details of each country - under the law governing the policy:

(I) a policyholder may nominate one or more beneficiaries by waiving his right of revocation, i.e. by irrevocable nomination of the beneficiary(ies) as “irrevocable beneficiary(ies)”;

or

(II) the nominated beneficiary(ies) may accept the benefit of the life insurance policy, and thus become an “accepting beneficiary(ies)".

These two nominations make it possible to ensure that the benefits of the inheritance finally reach the person(s) chosen by the policyholder.

In most countries, even if one of these nominations has already been selected, the policyholder/ may, provided he has been authorised by the nominated beneficiary(ies), continue to exercise his rights under the policy (for example: to make surrenders, to pledge policies, to carry out other transactions on his policy, etc.), except in certain cases, as is the case under Spanish law, where irrevocable nomination of the beneficiaries implies waiver of the right to revoke the nomination and makes it impossible for him to exercise the rights to surrender, to advance, to reduce or to pledge the policy.

Role of the accepting recipient in a pledge

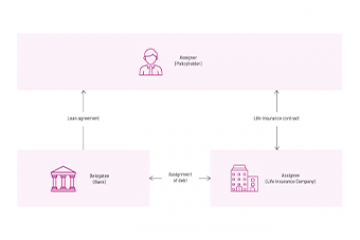

Among these rights is the use of life insurance as a credit instrument, i.e. a mechanism by which the policyholder may pledge his life insurance policy in order to guarantee a loan. In such cases, the policyholder may pledge the rights arising from his life insurance policy, but not the underlying assets linked to this same policy.

Therefore, where the policyholder has made an irrevocable nomination or where the nominated beneficiary has accepted his nomination, the establishment of a pledge must also be preceded by the latter’s written agreement or consent.

Once the pledge over the policy has been established, all transactions such as :

- partial or total surrenders,

- transfers of funds relating to the policy,

- changes in the risk profile or investment strategy,

- and any other transaction,

generally require prior written consent not only by the creditor (for example, the bank) but also by the irrevocable beneficiary or accepting beneficiary.

In conclusion, a life insurance policy will enable the policyholder to set up a wealth plan with advantageous tax treatment, and in most cases to continue to dispose freely of his policy, even if he has nominated Irrevocable or accepting beneficiary(ies), subject to having obtained the consent of these beneficiaries.

When the designated beneficiary of a life insurance contract has accepted its designation, he must also consent to the pledging of the contract. Moreover, when the pledging of the contract is made, all transactions such as: surrender, switch, ..., require the consent of the creditor (for example the bank) but also of the irrevocable or accepting beneficiary.