Asset protection and estate planning

Text version of the interview:

« Clients are looking for flexible and tailor-made solutions »

Clients usually come to Luxembourg in search of an insurance company. Will they perhaps be faced with problems, particularly concerning the transfer of inherited assets? Or do they simply want to plan for their retirement? In general, clients are looking for flexible and tailor-made solutions. I have a concrete example in mind. Mr and Mrs Bernard are 80 years old.

They live in France and have contacted us because they’ll be moving to Portugal, under its tax regime for non-habitual residents. They are leaving their children and grandchildren in France, as well as all their real estate assets. In France, life insurance policies are a well-known tool, so they are looking for a solution such as the Luxembourg life insurance policy.

« The roles of life insurance policies in terms of wealth and inheritance planning »

In fact, life insurance policies have an important role to play in terms of wealth and inheritance planning and this is thanks, in particular, to the beneficiary clause which makes it possible to nominate the beneficiaries of one's choice and also (why not?) to make arrangements for a multi-generational transfer of assets.

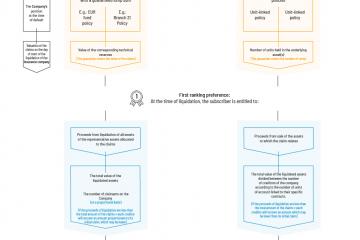

In our example, we might imagine that Mr and Mrs Bernard have just decided to make their children and grandchildren beneficiaries of their policy, in order, as of today, to transfer their estate to the next generation. In addition to these well-known advantages of life insurance for the transfer of assets, Luxembourg offers policyholders a unique protection using the triangle of security scheme. The ‘triangle of security’ is the name commonly used to designate the three-sided relationship which exists between: the insurance company; the custodian bank (which holds the assets of subscribers to insurance policies); and, finally, the Luxembourg regulator (namely, the Commissariat aux Assurances).

This three-party relationship will be evidenced by an agreement, signed by all the parties and which defines each party’s roles and obligations. In particular, the principle of the protection of assets in Luxembourg is based on the insurance company’s statutory obligation to deposit the assets representing these claims with an independent bank approved by the Commissariat aux Assurances.

« A true segregation of the assets »

Does this mean that each party will play its role independently, and that there is a true segregation of the assets? A segregation of the Company's assets, held separately from the assets of the custodian bank?

« Luxembourg: protection of the capital »

Yes, and what’s more Luxembourg has further strengthened this protection by the separation of assets under the Law of 10 August 2018 which amended the law on the insurance sector and introduced provisions to this end. By instituting, for assets representing clients’ claims, an obligation to separate claims representing - on one hand - the policies in guaranteed funds, from claims representing unit-linked policies, on the other. This makes it possible to tailor the protection as closely as possible to the policy taken out by clients, depending on the type of policy they’ve chosen.

This principle of separation of assets enables subscribers, as claimants, to take priority over any other claimant which the company may have (and particularly the State), and will thus guarantee the protection of their capital if the insurance company goes bankrupt.

« The special privilege »

We’re talking here about a special privilege, which means that insurance claimants have priority over other creditors who also follow the preferences system. This is precisely the type of mechanism which clients are looking for when they’re searching for an asset protection scheme, at national level, in Luxembourg.

« Policyholders recover their claims »

Yes, absolutely, and, thanks to this protection scheme, its neighbouring countries regard Luxembourg in this way by, as do other countries in Europe. This is particularly true for our clients who are moving to Portugal, because the Luxembourg system offers protection which is truly unique and the best in Europe, which you cannot find elsewhere.

Mr and Mrs Bernard would not enjoy equivalent protection in France or Portugal if they chose to take out a policy with a local company in either of these countries rather than with a Luxembourg company. Luxembourg also offers protection not only for clients' cash but also provides for certain assets which one could describe as unconventional. Mr and Mrs Bernard may want to include the shares of their family company in their insurance policy. It's a company they don't really manage any more: because of their advanced age, they’ve hired an independent executive to manage the company.

But this is the company which holds the family assets. If they were to include it in a life insurance policy, they wouldn’t want this company to be liquidated or transferred to third parties if ever the insurance company were to go bankrupt.

Now Luxembourg has also made it possible to address this kind of concern among our client base since, after introduction of the law of 10 August 2018, policyholders will also be able, at their request, to recover their claims not just in cash but in kind, if they so wish.

« Tax neutrality »

So, apart from the principles of security and super preference, I’d say we can also talk about a principle of tax neutrality, knowing that what policyholders are looking for when they take out a life insurance policy is, above all, to know what the applicable tax regime is. The tax regime applicable to their life insurance policy will be the tax regime of their place of residence. In our example, we can state that this will be the Portuguese tax system.

« The framework for portability »

I agree, and furthermore it’s perfectly possible that, in the end, Mr and Mrs Bernard may decide to go back to France or - why not - move to another country. The Luxembourg insurance policy also provides them with the framework for portability, which will enable them to move from one country to another, in complete peace of mind, while maintaining their policy and without having to subscribe to a new one or modify any wealth planning they may already have put in place.

In addition to all these advantages, as well as the security, tax neutrality and portability, we should also add the professional confidentiality which binds insurance companies in Luxembourg.

« Professional confidentiality »

Professional confidentiality may be waived in certain situations. It’s true that this adds another layer to the mechanism for asset protection and this is why, in addition to all the arguments already mentioned, confidentiality is yet another reason why clients find Luxembourg life insurance policies attractive.

« Luxembourg: an encouraging and reassuring environment to take out a life insurance policy »

Absolutely: the regulatory framework for life insurance in Luxembourg offers real security, both legally, in terms of the protection of assets, and in terms of the savings invested. Luxembourg also has the advantage of a fairly stable economic and political environment. So, all these component parts are likely to create an encouraging and reassuring environment for clients and will encourage them to take out a policy with a Luxembourg insurance company. A policy within which they can place all their assets, whether these are listed or unlisted securities or even real estate.

Finally, we can say that today, even more so than before, the Luxembourg life insurance policy is a true asset management tool, and one which has become indispensable.

Exactly so.

Luxembourg offers legal security and asset protection for policyholders of unit-linked life insurance policies. Luxembourg benefits from a stable economic and political situation and a progressive and innovative legal framework, which makes the Luxembourg life insurance contract an essential wealth management tool.