How works the pledging a life insurance contract in the context of operations on the contract

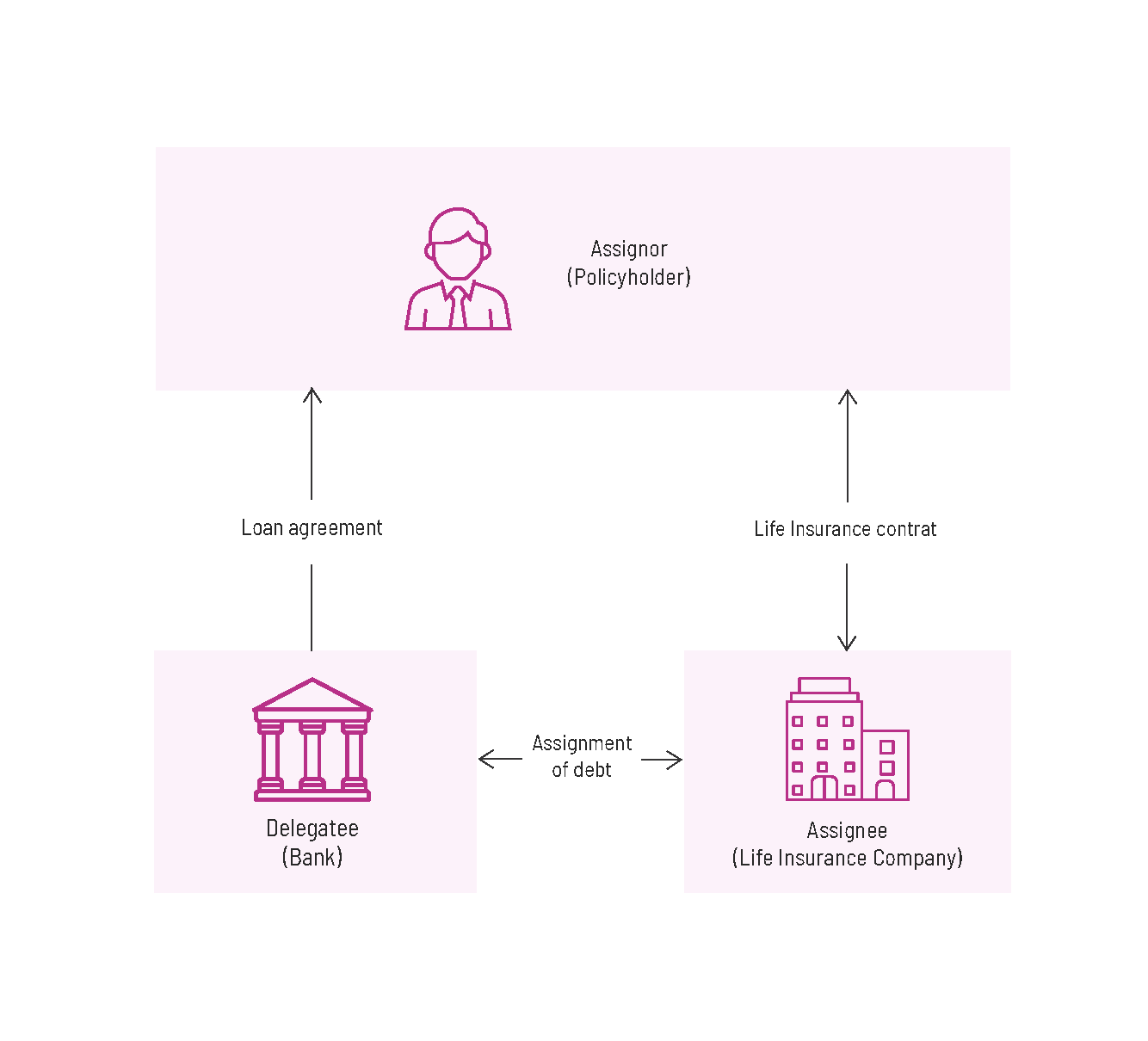

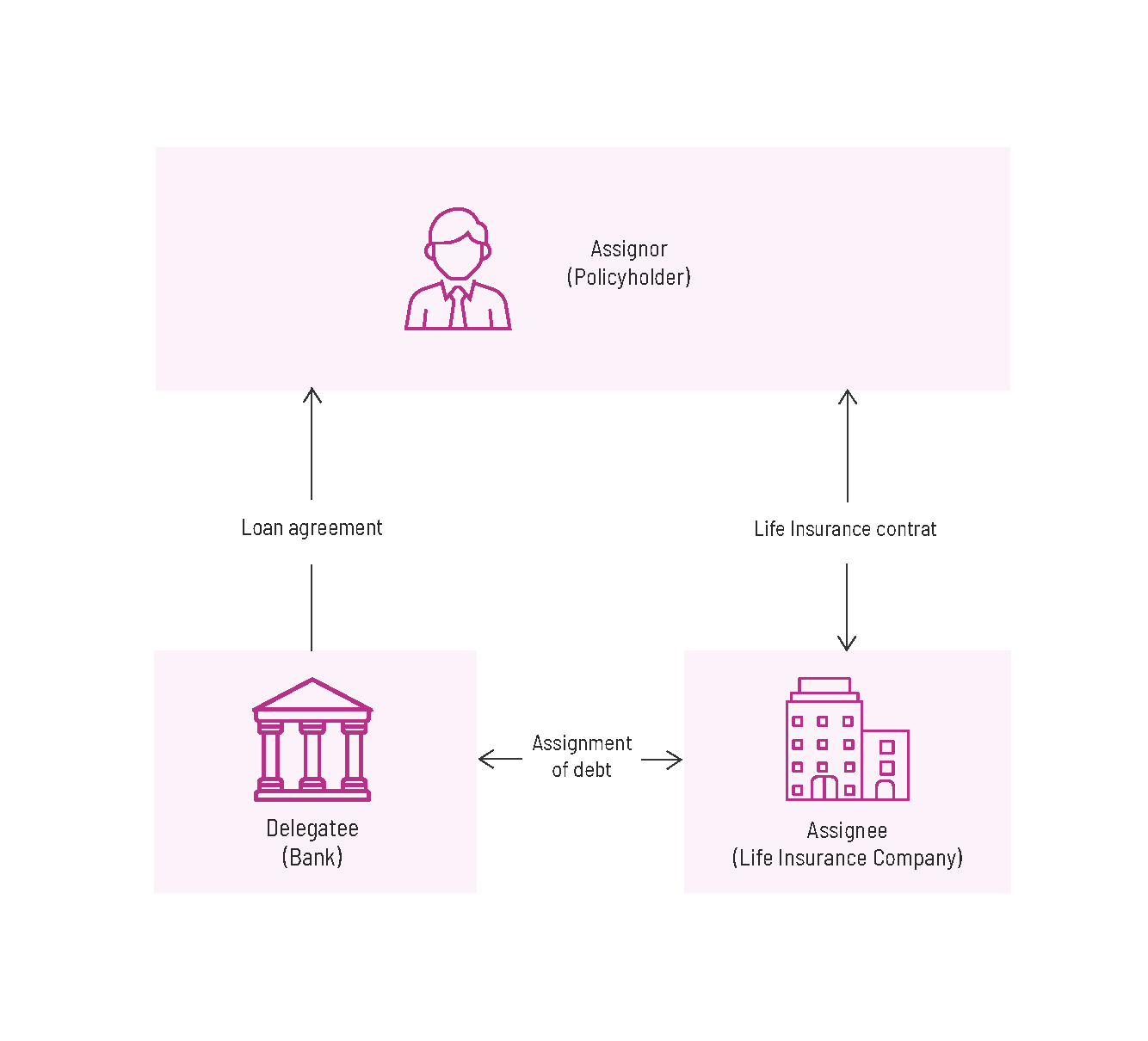

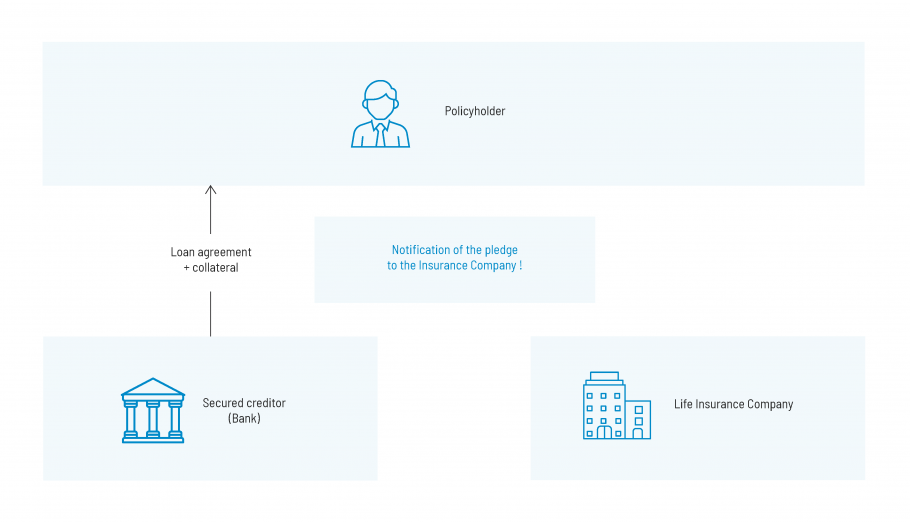

Assignment of debt

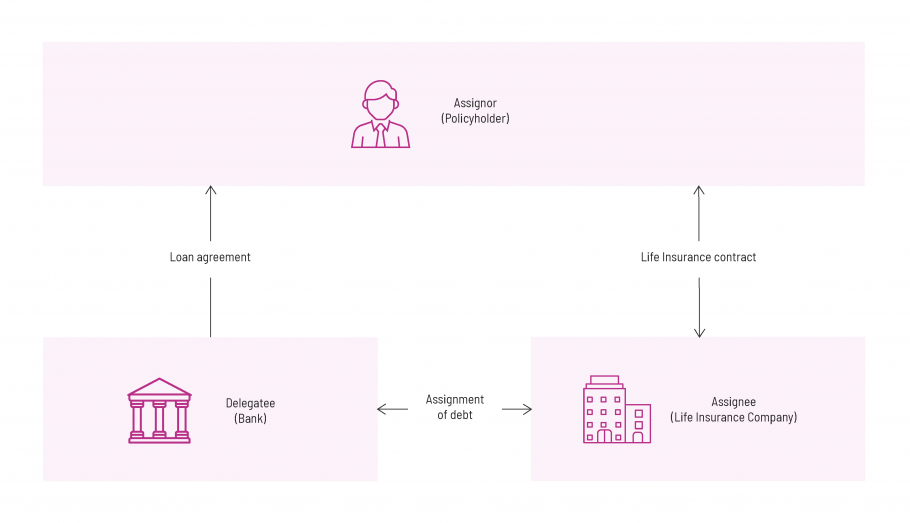

Collateral / Pledge

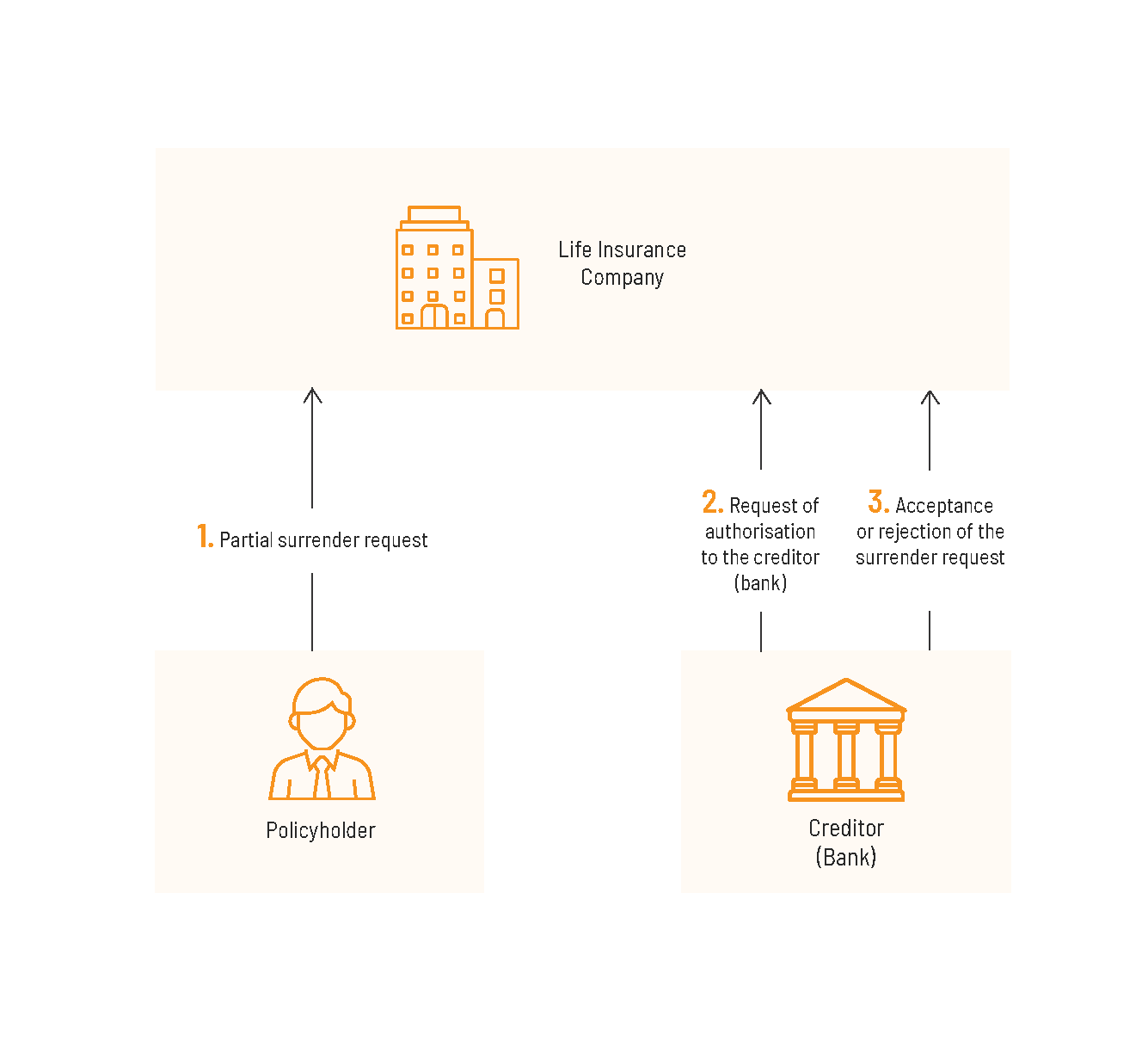

How works the pledge in the context of a surrender request from the policyholder.

A life insurance policy can be pledged by the policyholder. It’s an agreement between the policyholder, the creditor (bank) and the life insurance company, whereby the life insurance contract is used as guarantee in exchange for a financial loan.

There are different types of collateral, the most common ones – assignment of debt and pledge - are described below.

When a life insurance contract has been pledged, the policyholder can no longer act freely during management acts such as a switch or a surrender. He must request prior authorisation to the creditor (banking institution).

When a life insurance contract is pledged to a credit institution, whether as part of a delegated claim, a pledge or a collateral, it is no longer possible to make changes to the contract freely. Indeed, the policyholder must first request the creditor's authorisation if he wishes to make a surrender on his life insurance policy.