What are the main features of Insurance Distribution Directive (IDD) and how does it work?

The Insurance Distribution Directive (IDD), which introduced new rules for the distribution of insurance products, came into force on the 1st October 2018. What are its main features and how does it work?

IDD groups together several key provisions.

The POG deals with the monitoring and governance of products and comprises several phases

The design phase aims to identify the interests and objectives of the target market and to design the product in line with the characteristics of this target market.

Once the product has been designed, a test is carried out before it is marketed to ensure that it meets the requirements of the target market as identified during the design phase.

During the distribution phase, the distributor must respect the distribution strategy selected by the insurance undertaking and must manage any conflicts of interest which may arise.

Finally, the POG ends with the documentation and storage for five years of all relevant information in order to be able to show the supervisory authorities the efforts made to ensure compliance with the POG

There are multiple professional requirements for distributors and the people responsible of the distribution

An extract of their criminal record is required every three or four years, as well as a proof

that they had not gone bankrupt lately.

They must receive initial training. This training covers both the technical and communication aspects but also the specific features of the products they are expected to distribute. It is possible to be exempt, depending on the diplomas and professional experience acquired and with the approval of the CAA.

In addition to the initial training, continuous training is obligatory for at least 15 hours per years.

The management of conflicts of interest is another provision of IDD

The insurance undertaking must disclose any direct or indirect holding of10% or more in the voting rights or capital of a distributor and vice-versa. Where an exclusive contract exists between the insurance undertaking and the distributor, this must be disclosed to the client before the policy is underwritten.

The distributor is also required to indicate the nature of the remuneration he receives in connection with the policy which is about to be underwritten. He musts, therefore, declare whether his remuneration comprises:

- the fees paid directly by the client, their amount and method of calculation;

- commissions;

- or any other type of remuneration, whether in cash or not.

For insurance-based investment products, if a potential conflict of interest is discovered, its source and nature must be disclosed to the client before the policy is underwritten. Product and distribution related costs must also be reported in aggregated form, also before the policy is underwritten. And, if the client so requests, he can be sent the details of these costs every year.

IDD also controls the financial incentives offered to distributors

All fees, commissions or non-pecuniary benefits furnished by or to an insurance distributor or insurance undertaking in connection with the distribution of an insurance-based investment product may be considered as incentives.

According to MiFID II, incentives may be retained if they are intended to improve the quality of the service in question to the client whereas, according to IDD, incentives may be retained to the extent that they do not have a negative impact on the quality of the service provided to the client.

The incentive may result in a negative effect if, for example, it:

- encourages the recommendation of a product which is not the most appropriate;

- is calculated only based on quantitative criteria;

- is disproportionate with the value of the product.

An incentive may prevent a negative impact if, for example, it:

- is based mainly on qualitative criteria;

- may be reimbursed in extreme circumstances which result in an immediate surrender;

- or it is used to improve the distributor's training in ethical and regulatory standards.

The Key Information Document (‘KID’) is a document created by the insurance undertaking and distributed to clients before the policy is underwritten

This is a single, stand-alone document which: contains accurate, clear and not misleading information; is of three A4 pages; and is available in at least one of the official languages used in the Member State in which the distribution takes place, or in another language accepted by the competent authorities.

It must be delivered prior to any offer or application for underwriting so that retail investors may review the document before becoming contractually bound. This contains:

- a description of the type of PRIIP and its maturity date, investment objectives, type of retail investor, information on insurance benefits;

- a brief description of the risk and performance profile as well as the performance scenarios;

- the existence of a guarantee system, the name of the guarantor, or operator, of the investor compensation scheme, and the risks covered and not covered;

- the presentation of the composition of all PRIIP costs, including direct and indirect, recurring, one-time and incidental costs;

- the conditions for a disinvestment before maturity and any fees and penalties applied;

- the complaints procedure;

- a brief indication of any other relevant information.

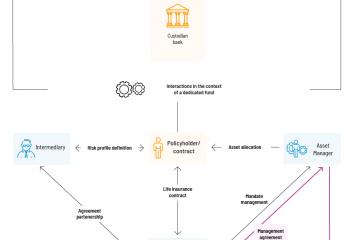

Distribution of the insurance product

When distributing the insurance product, once he has declared everything he had to declare to his client, the distributor collects the demands and needs of his customer in order to ensure consistency between the product sought and the product distributed.

For sales with advice, we collect: the client’s level of knowledge of - and experience in - the investment sector, his financial situation, and his investment objectives.

The resulting suitability test must contain:

- the advice given to the client;

- the precise reasons why the recommended product fits better with the client's profile;

- clarification that the purpose of this document is to ensure respect for the client’s .best interests;

- the accuracy of the frequency of submission of the declaration of adequacy, if this is periodic.

It is possible to distribute the product to the client without advice: if the suitability test reveals a discrepancy between the product and the client's profile and that the client insists to underwrite it; or if the client refuses to provide all the information required for conducting the suitability test but still wishes to underwrite that product.

In the case of sales without advice, only the client’s degree of knowledge and experience in the investment sector is collected. Either it is sufficient and the product is distributed; or it is not sufficient or the client refuses to provide the necessary information but wishes to underwrite that product anyway and he is warned.

IDD or the Insurance Distribution Directive imposes rules on the distribution of insurance products such as product supervision, professional requirements for distributors, the management of conflicts of interest or the delivery of a KID (key information document) to the life insurance contract policyholder.