Life insurance and skipping a generation

Skipping a generation means passing on an inheritance to the second generation. What is the point of skipping a generation under a life insurance policy and how does it work?

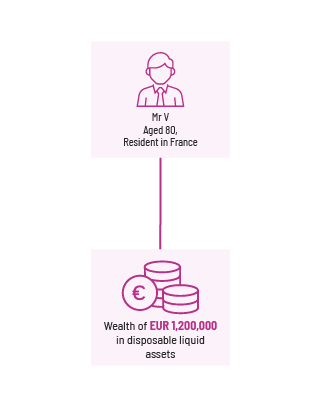

His wish

- To bequeath part of this cash directly to his 9-year-old grandson

- That his grandson may not dispose of these inherited assets until he is 25 years old

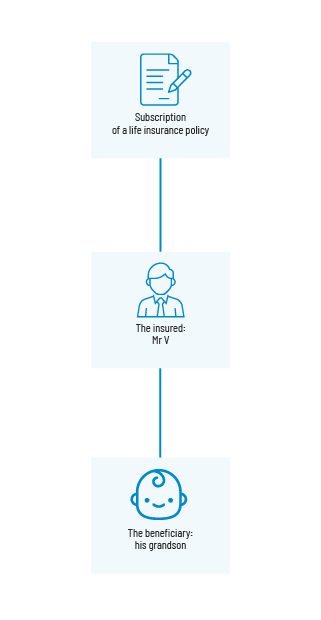

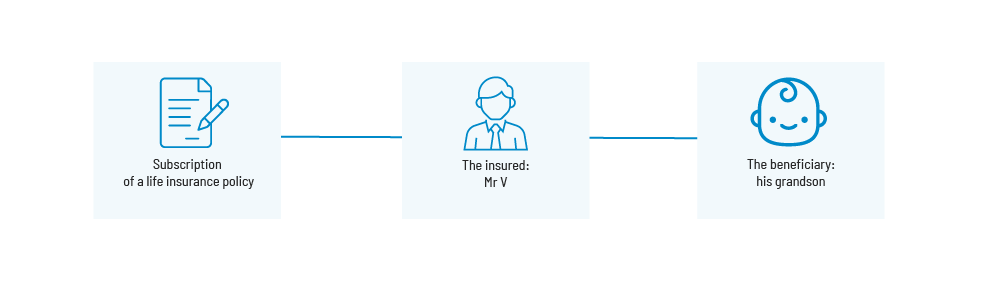

Solution

Takes out a life insurance policy drafted to include a specific beneficiary clause with one certain condition, namely:

A beneficiary clause with the obligation to reinvest the death benefits in a life insurance policy and a temporary inalienability clause under which surrenders are blocked until the subscriber's 25th birthday).

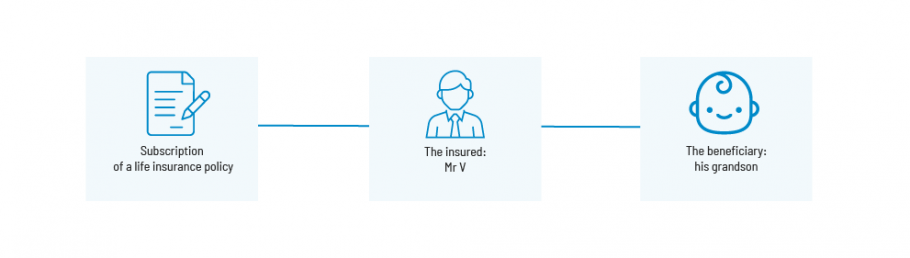

On the death of the insured

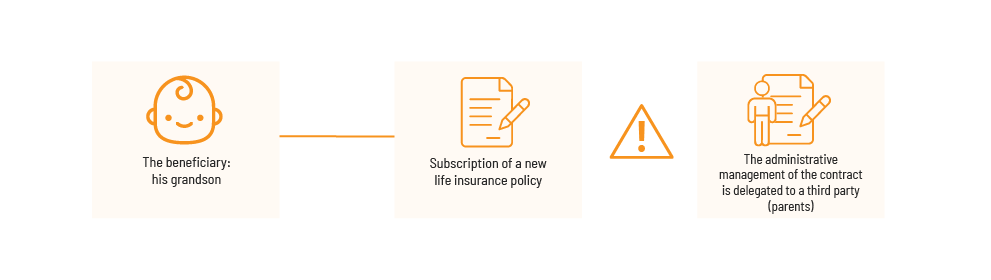

Profits from the policy are reinvested in a new insurance policy for which the policyholder/insured is the grandson.

Beneficiaries must be the legal heirs.

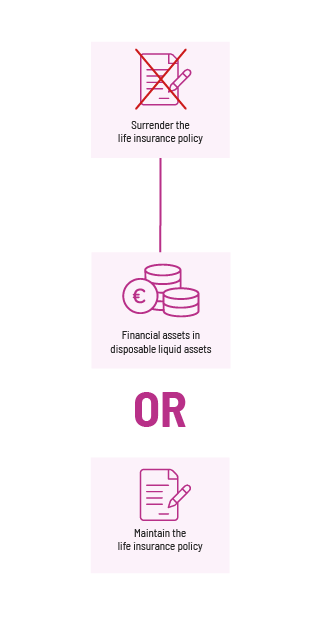

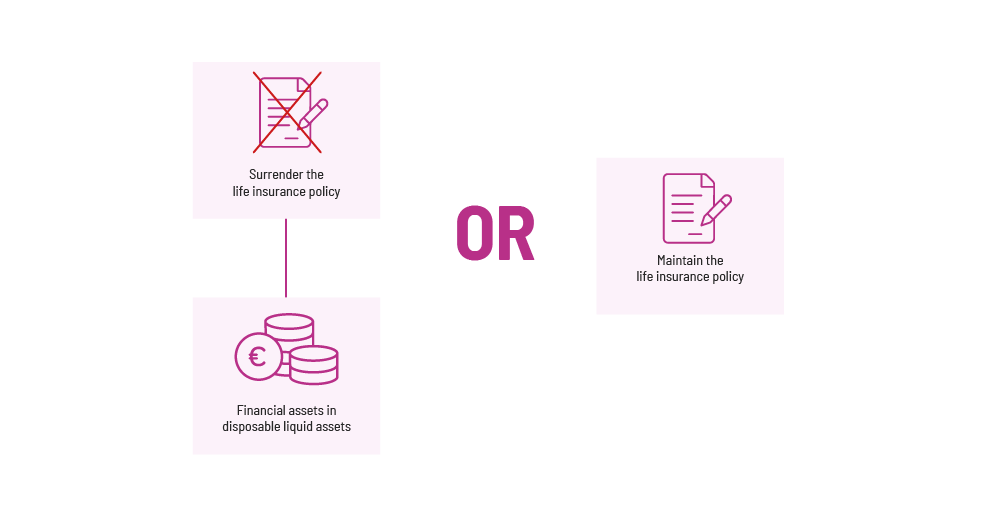

On the grandson’s 25th birthday

| Advantages | Key points |

|

|

Skipping a generation means nominating the second generation as beneficiary of a Luxembourg life insurance policy. The mechanism of skipping a generation allows direct transmission to grandchildren without taxing the estate twice. This facilitates the balance of the intergenerational transmission.