European statistics on life insurance

LUXEMBOURG INSURERS CAPTURE 3% OF THE LIFE INSURANCE PREMIUMS PAID IN EUROPE

In recent years, the specialised press has trumpeted the existence of life insurance policies marketed by Luxembourg companies. What does Luxembourg represent in this sector? In which countries are these policies marketed and which type of policy are they?

A STILL GROWING SECTOR

The life insurance sector in Luxembourg remains buoyant, with life insurance inflows in 2022 of EUR 23.1 billion1. The sector is down 11% from a record year in 2021, with reserves at 161.4 billion2 (-6.5%).

The life insurance sector represents a significant part of the Luxembourg financial sector, although it is still far from the EUR 303 billion managed in private banking (2020) and the EUR 5,028 billion in investment funds (2022) 3. Life insurance premiums since 2009 has seen fairly significant annual variations: 14.65 billion in 2011 and 23.1 billion in 2022 (25.6 billion in 2021, a record year to date).

EUROPEAN SECTOR IN SLIGHT OUTFLOW

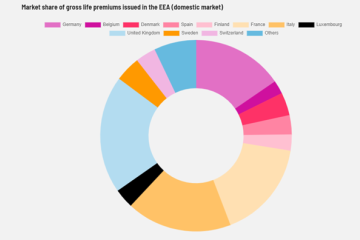

The European life insurance sector represents EUR 668 billion in gross premiums in Europe4 by 2020. A trend that has been slightly declining since 2018, due to the economic difficulties and the uncertainty created by the chalenges related to COVID-19.

The figures available for 2021 show that, with 40.87%, France is the largest market for Luxembourg insurers, while Italy has seen a decline in recent years (26% in 2018 compared with 16% in 2021); Portugal has seen a slight increase. By comparison, at European level, the United Kingdom, France, Italy and Germany together account for 70% of global inflows.

Finally, almost 74% of life insurance inflows in 2021 were in unit-linked products whose risk is borne by the policyholder, a segment that has been growing in recent years (64.5% in 2018).

1. Overall premium income of the life insurance sector in Luxembourg (National and International Life, Non-Life Source: ACA press release. Unless otherwise stated, figures quoted are as at 31 December 2022).

2. Source ACA

3. Source CSSF

4. Source Insurance Europe: gross direct life premiums written in the total market - within the EEA.

5. Source: Commissariat aux Assurances

In Europe in 2017, life insurance contracts represented 710 billion gross premiums. Life insurance companies working in FPS from Luxembourg, although collecting nearly 22 billion, represented only 3% of this total. The written premium come mainly from France and Italy, countries that have always shown a strong attraction for the advantages of Luxembourg life insurance contracts.