History of life insurance in Europe

The Greeks and Romans introduced an early form of life insurance: a group of individuals contribute for a certain time. The sum is set aside until it is given to the last survivor of the group.

The guilds were associations or cooperatives of persons conducting the same business, e.g. the association of merchants. Guilds in the Middle Ages contributed to the funeral expenses of their deceased members.

First policy on the life of William Gibbons: guaranteed the payment of a sum if his death occured within 12 months.

Appearance of life insurance, as a supplement to marine insurance, to insure passengers and slaves.

Appearance of dowry insurance: amount paid by the parents on the birth of a child. Embryonic estate planning.

Establishment of the Widows Fund: intended to provide a pension for the widows of persons who have held an important position and belonged to the upper classes.

The banker Lorenzo Tonti develops the tontine: several individuals invest in a common fund which would make it possible to obtain a life annuity.

Creation of the first life table by Edmund Halley - British astronomer and engineer.

Emergence of personal insurance to secure crews and slaves against the risk of shipwreck.

Birth of the Compagnie Royale d'assurances sur la vie (organisation offering life). It does not survive the revolution.

Foundation of the Gothaer Lebensversicherungsbank through which the first life insurance policies were sold.

Amicable Society for a Perpetual Insurance Office: the first life insurance company in the world. Each member pays a fixed annual premium per share. At the end of the year, part of the contribution is divided between the wives and children of deceased members.

Establishment of the Society for Equitable Insurance on Lives and Survivorship. First mutual insurance entity in the world to offer premiums based on age and mortality rates. The emergence of actuaries.

The growth in the number of insurance companies and the creation of mutuals / cooperatives.

The emergence of the policy in units of account to offset the effects of inflation.

The advantages of a unit-linked life insurance policy

Why choose a life insurance policy? What are the advantages?

How a life insurance policy works

Life insurance policy / Trust / Foundation: the comparative

History of life insurance in Europe

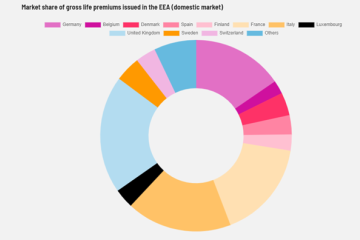

European statistics on life insurance

The first life insurance policies appeared in antiquity. It has always been about preserving an estate for a heir, insuring people in the event of death or even allowing widows to receive an annuity. The first signs of inheritance planning through life insurance contracts are therefore already several centuries old.