The advantages of a unit-linked life insurance policy

issued in Luxembourg

Text version of the animated infographic:

The advantages of unit-linked life insurance policy taken out in Luxembourg

The unit-linked life insurance policy taken out in Luxembourg combines the advantages of Luxembourg prudential law with the specific civil and tax characteristics of the policyholder's country of residence. Here is a non-exhaustive list of the different characteristics of this contract, in some of the countries of the European Union depending on the tax residence of the policyholder.

Luxembourg

- Super privilege

- Application of Luxembourg prudential law

- Mobility

- Access to investment in a broad class of assets

- Tax neutrality

French resident

- Optimization of transfer and inheritance tax, particularly when the premiums are paid before the 70th birthday of the insured

- Free nomination of beneficiaries

- Privileged tool for the management and transferring of wealth

- In the absence of redemptions: no capital gains tax

Belgian residents

- Optimisation of estate duty using wealth planning

- No withholding tax in the event of redemptions

- Free nomination of Beneficiaries

- Transfer of assets with the ability to retain a power of control

Portuguese residents

- Inheritance planning tool enabling the transfer of wealth without inheritance tax

- Subscription by multiple policyholders and on the lives of multiple policyholders with a last-to-die benefit payment

- Free nomination of Beneficiaries

- In the absence of surrenders : no capital gains tax

- Advantageous tax treatment on surrenders after 5 and 8 years

Italian residents

- No inheritance tax

- In the absence of surrenders: no capital gains tax

- Life insurance policies not attachable

- Free nomination of beneficiaries

Spanish residents

- In the absence of surrenders: no capital gains tax

- Planning and inheritance optimisation tool

- Possibility of benefiting from an exemption from ISF, on certain conditions

- Free nomination of Beneficiaries

German residents

- No tax on premiums

- In the absence of surrenders: no capital gains tax

- Beneficial taxation if the term of the policy is longer than 12 years and the minimum age of the Beneficiary is 62

- Exemption of 15% of capital gains from 1 January 2018 if they come from investment funds

- No capital gains tax if the Subscriber to the policy is the beneficiary

Polish residents

- The benefit of the insurance contract is not included in the inheritance estate

- The life insurance policy is not included in the reserved portion

- Partial surrender below the amount of the premium exempt from capital gains tax

Finnish residents

- Deferral of income tax and capital gains

- No tax on premiums

- In the absence of surrenders from the policy, no capital gains tax

- No declaration needed by the policyholder until a taxable event

- Free nomination of beneficiaries

- Planning and inheritance optimisation tool

- Tax relief for dividends

Swedish residents

- No tax on inheritance or gifts from close relatives

- No tax on premiums

- Free nomination of beneficiaries

- Planning and inheritance optimisation tool

- Possibility for the policyholder to actively participate in the investment decisions

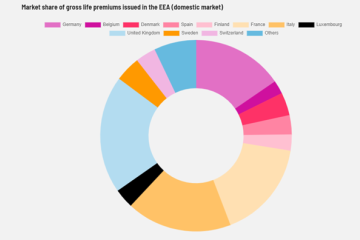

Whether you are a Belgian, French, Italian or Portuguese resident, the characteristics that apply to the Luxembourg life insurance contract you take out are not the same. In all cases, they include: super-privilege, mobility, access to a wide range of assets, tax neutrality. In addition to these advantages, depending on the policyholder's country of residence, there are other advantages: free nomination of beneficiaries, optimisation of inheritance tax, no capital gains tax in the event of surrender, ...