How has Luxembourg become the leader in cross-border life insurance?

Interview: Luxembourg Minister of finance

"I believe that Luxembourg and life insurance is a success story"

Luxembourg's Minister of Finance Pierre Gramegna prefaces this second chapter on life insurance Freedom to Provide Services.

Focus on the success story of life insurance, the impact of Brexit and its vision for the future.

Text version of the interview:

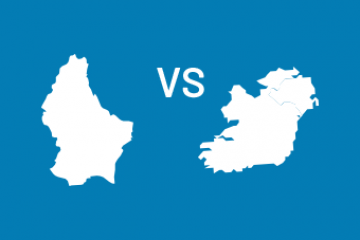

How has Luxembourg become a country which is a leader in encouraging the Freedom to Provide Services in insurance?

Luxembourg is probably the country which has best known how to take advantage of the large single market. What does the large single market do? Well, it gives you a passport to sell services outside Luxembourg, in all the other countries of the single market which has 500 million consumers. This is what we’ve done for life insurance and we note that today Luxembourg is one of the leaders, if not the leader, in cross-border life insurance services, where we have almost 20 billion in premiums and continual growth. We have also seen strong growth in the field of non-life insurance or, in the context of Brexit, growth of more than 20% to just over 3 billion in premiums.

Why is Luxembourg particularly attractive?

First, because it is a triple-A country and insurers like to set up in a safe country. There are only about ten financial triple-A countries in the world and we are one of them. Second, we have a very interesting product range which takes into account the specific needs, different cultures and languages of clients and, for this purpose, our country’s multilingualism and multiculturalism is a great help. Finally, the interaction between the world of insurance and the financial centre is obvious and the products, whether private banking itself or investment funds, are completely complementary with what life insurance can offer. For all these reasons, I believe that Luxembourg and life insurance is a great success story.

What will be the impact of Brexit on the insurance sector in Luxembourg?

I believe we have seen that in the short term Luxembourg has been able to do well in the context of Brexit. We have been advocates of a soft Brexit which has proved impossible but we will do everything we can to keep open, and not to burn, our existing bridges with the United Kingdom; and our strategy has been to cooperate with the financial centre in London. This is just as well, because - despite Brexit - 11 insurance companies which were not present in Luxembourg have chosen to set up in our country. To what is this due? I think this is due, among other things, to the existence of our already very dynamic financial centre. Second, the fact that we have a regulator, the Commissariat aux Assurances (CAA), which is specifically equipped to deal with insurance: it does not cover banks, it does not cover investment funds, it is focused solely on insurance. And then, third, it is clear that insurance products today are increasingly sophisticated and personalised, and, since we in Luxembourg are used to doing everything we can to make our customers happy, we have done the same in the life insurance sector and the result has been very satisfactory.

How do you see the future of insurance in the Freedom to Provide Services? Threats and opportunities?

Being an optimist, I will start with the opportunities, and I would say that there are two major trends which will have a major impact on the Freedom to Provide Services in the insurance sector. The first is the digitisation of the economy and the way in which life insurance benefits are delivered to clients. Digitisation and eCommerce mean that marketing is much more direct, with fewer intermediaries and this, it seems to me, should benefit Luxembourg, which has, of course, an extremely powerful data centre network, is a very well organised country, and is easily accessible from all over Europe. The second factor I would like to highlight as an opportunity is everything to do with green finance. How to use life insurance, and link it up to sustainable finance, this is the question. I must say that I haven’t given it much thought but, as a strong advocate of the sustainable economy and also of the leverage which our financial centre can use to achieve the objectives of the Paris Agreement on Climate Change, I am counting on the insurance sector to find products which will appeal as much to customers' ecological conscience as to their private interests.

As regards threats, these are more macroeconomic and political in nature. Perhaps the one that worries me most is the trade tension between the United States and China and the United States and Europe, because the freedom to provide services obviously works in open markets and if economic and trade tensions between countries persist, if markets close, it will be particularly negative for life insurance. Political tensions have always existed, they will continue to exist, we have European parliamentary elections in May and we will have to live with the consequences of these elections but I am convinced that the single market for services will remain intact and that the life insurance sector will continue to grow.

Luxembourg is probably the country that has been able to make the most of the Directive on the Freedom to Provide Services. Indeed, Luxembourg is one of the leaders in cross-border life insurance with almost 20 billion premiums and constant growth. Luxembourg's stability, its triple A rating, its range of products, its sense of constant innovation and its interaction between the life insurance and the financial sectors make it a first-rate player.