Does the Luxembourg life insurance policy really exist ?

We often refer to a Luxembourg life insurance policy, but what is it exactly? Is the Luxembourg policy myth or reality?

A life insurance policy offered from Luxembourg under the Freedom to Provide Services is a policy where the prudential law, which determines both the rules for the protection of invested savings and the rules relating to the acceptance of the underlying investments, is Luxembourg law.

On the other side, the contractual aspects are defined by the policyholder's place of residence*.

Finally, the tax regime depends solely on the place of residence of the policyholder (or sometimes of the beneficiaries, in an international inheritance regime) whatever law may be applicable to the life insurance policy. In Luxembourg, the policyholder will not be liable for any tax. This is called tax neutrality.

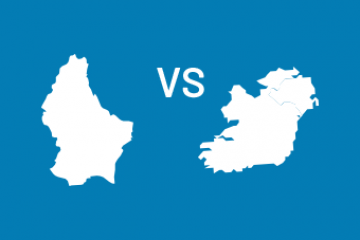

We should not refer to a Luxembourg policy when the policyholder is resident in France, but rather to a French policy taken out with a Luxembourg life insurance company to which the prudential rules of Luxembourg apply.

| Laws applicable to the Luxembourg life insurance policy | |

|---|---|

| Law of the country of residence of the policyholder* | Luxembourg law |

|

Contractual aspects and their effects, such as:

|

Financial aspects of the policy: Prudential, accounting and financial standards = the rule of Home Country Control |

* Since the Treaty of Rome in 1980, policyholders are free to choose the law applicable to their insurance policies and thus to opt for a law other than that of their country of residence. For more information on this subject, please download the whole white chapter.

** The public interest rules of the policyholder's country of residence may, exceptionally, be applied if they are justified and concern a subject not harmonised at European level, are non-discriminatory, and are objectively necessary and proportionate to the objective being pursued.

The term "Luxembourg life insurance policy" is commonly used, but the reality is not so simple. Indeed, a contract taken out in Luxembourg and offered by a life insurance company under the Freedom to Provide Services is subject to Luxembourg prudential law. The rules for the policyholder protection (triangle of security and super-privilege) as well as the rules relating to the acceptance of the underlying investments are subject to Luxembourg law. On the other hand, the contractual law (right of redemption, designation of beneficiary, ... ) as well as the taxation are those of the policyholder's place of residence.