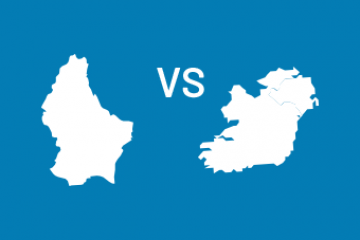

| Total number of insurance and reinsurance companies |

At 1 July 2018, there were a total of 300 insurance companies

- including 52 companies in the life insurance sector with approximately 2,400 employees

|

At the start of 2017, there were a total 130 insurance companies

- including 32 companies in the international life insurance sector

|

| Assets under management |

More than €4.20 trillion in assets under management, distributed through more than 70 centres within the country (2/3 of the funds are distributed internationally)

|

More than €4.82 trillion in assets under management

|

| New business, in recent years, distributed by companies with headquarters in Luxembourg |

Developments in 2018:

- + 2.9% in terms of premiums

(Between € 22.50 and 25.00 trillion in premiums, including close to €20.00 billion in FPS premiums)

|

Developments in 2017:

- - 17.8% in terms of premiums (€15.153 billion in FPS premiums)

|

|

|

|

Note: In life insurance, the average growth in Europe averaged 0.8%

|

| Units of Account (share, average premium) |

Breakdown of Units of Account in 2018 :

• Equities and equity UCIs (between 50 and 60%)

• Other assets (between 10 and 20%)

• Private sector bonds (just over 10%)

• Bond UCIs (nearly 10%)

• Public sector bonds (less than 5%)

Observation: Decrease of bonds in recent years.

Average premium: 38,784,331 million in total written premiums, of which 23,840,743 million in life insurance.

|

Breakdown of Units of Account in 2018 :

• Fund units (57%)

• Debt securities (17%)

• Shareholders' equity (14%)

Average premium:

In 2017, €15,410.3 billion in total premiums written, including €11,841 billion in life insurance.

|

| Security |

1. Security triangle2 :

Every insurance company is required to deposit the policies’ technical reserves with independent custodian banks, which protects investors.

-> Tripartite agreement between the Insurance Company, the Bank, and the Supervisory Authority (the Commissariat Aux Assurances)

2. Super privilege3 :

The policyholders or subscribers of the policy are first ranking creditors if the Company is declared bankrupt. In cases where the company's segregated assets are not sufficient to reimburse the policyholders or subscribers, the latter also enjoy a preferential right over the other assets. There are, however, some exceptions to this latter privilege.

3. Multi-currency life insurance policies:

Enables non-nationals to avoid the foreign exchange risk

|

1. Article 9(1) of Irish Law I.S. 168/2003 :

Every Irish insurance company has the same obligation to deposit policies’ technical reserves with independent custodian banks in order to protect investors.

2. Super privilege :

The policyholders or subscribers of the policy are first ranking creditors if the Company is declared bankrupt. In cases where the company's segregated assets are not sufficient to reimburse the policyholders or subscribers, the latter also enjoy a preferential right over the other assets.

|

| Ecosystem (value chain)4 |

ADVANTAGES OF LUXEMBOURG :

1. Neutralité fiscale

La fiscalité assortie à un contrat d’assurance-vie est celle du pays de résidence du preneur/souscripteur et, le cas échéant, des bénéficiaires.

1. Tax neutrality

The tax treatment of a life insurance policy is that of the country of residence of the policyholders or subscribers and, where applicable, of the beneficiaries.

2. Internationally competitive tax environment

83 treaties have been signed between Luxembourg and a third country

3. Pleasant place to live

High quality of life, international state schools, very attractive family taxation, interesting professional careers

4. Investment vehicles

Dedicated internal funds, Collective internal funds, Specialised insurance funds and External funds.

5. Cross-border expertise

More than 50 years of expertise, and one of the top three financial centres in Europe.

6. Creation of funds

No. 1 in Europe and No. 2 worldwide

7. Trust in the managers with Luxembourg funds

Top 13 in Private Equity

8. Hub comprising 140 international banks

Four central securities depositories total €13 trillion in assets under management

9. International leader

In debt capital markets and the structured finance market

10. Luxembourg Stock Exchange

Largest international listing centre in the world AND number one in the listing of international bonds in Europe (+ Green exchange)

11. Stable and dynamic economy

AAA rating

|

ADVANTAGES OF IRELAND :

1. Fosters a healthy regulatory and competitive environment

Growing reputation

2. Contributes to society and the economy

Healthy and growing economy but low productivity - weakened by Brexit

A+ ratio

3. Represents the interests of its members with the government, state agencies, regulators, public representatives, interest groups, the media and the general public

4. Represents the position of members at the European level

5. Favourable geographic situation

A staging post for global connectivity between America and Europe

6. Climate

Enables savings to be made in the cost of cooling IT equipment

|

| Financial hub: International trading platform |

1. Value of premiums in 2018

• French market: : €8.085.048.299

• Italian market : €6.120.291.847

• German market : €1.594.825.179

• Spanish market : €475.982.124,57

• Belgian market : €1.689.595.741,17

• Portuguese market : €558.182.159,4

• Nordic markets : €594.175.497 €

• Remaining EEA markets : €9.979.888.434

• Markets outside the EEA : €7.402.623

2. 140 international banks are present in Luxembourg and offer various services:

• Asset engineering

• Treasury services

• Banking services

• Custody and funds services

-> European passport

3. European centre for cross-border insurance with a dedicated insurance regulator

4. Strategic location with world class connectivity

|

1. Value of premiums in 2018:

• Italian market: €14,418,508

• UK market: €2,161,244

• Spanish market: €102,790

• German market: €141,220

• Remaining EEA markets : €254,79

• Non-EEA market : €136,769

2. 58 banks are present in Ireland

3. Strategic location worldwide

|