Interview: life insurance contract and italian fiduciary

Expert's word: questions to LAURA PAGANINI, Ser-Fid Italiana S.p.A.

The fiduciary in Italy is commonly used when taking out a life insurance policy. What role can it play for the policyholder?

Text version of the interview:

1/ What is a fiduciary?

In Italy there are two types of fiduciary companies: static fiduciaries and dynamic fiduciaries. Dynamic fiduciaries are better known as SIMs (stockbroking companies) or SGRs (asset management companies) and are regulated by a Consolidated Law which governs them, whereas static fiduciaries were created by Law no. 1966 of 1939. In particular, static trusts hold assets on behalf of third parties. Of course, this is not the only law which regulates static trusts: there are anti-money laundering regulations and, in particular, two other sets of regulation: one concerns MISE (i.e. applications to the Ministry which supervises the way trusts operate, namely the Ministerial Decree of 1995) and the other concerns the Bank of Italy. Thus, Law no. 141 of 2010 introduced regulations which were obligatory for some fiduciaries, whereas others asked to be regulated also by the Bank of Italy. Fiduciaries are well known for their role as tax withholding agents.

2/ What is a tax withholding agent and what is its function?

Tax withholding agents usually pay taxes in their own name but on behalf of their clients. What does this mean? It usually means that in such cases a fiduciary pays the taxes incurred on business conducted on behalf of clients, but in its own name and within the time limits provided for by law. It may pay both direct and indirect taxes on the positions of various kinds held in its name. These may be taxes on capital gains and other profits, as well as indirect taxes often better known as stamp duty.

3/ Do similar arrangements exist abroad?

Fiduciaries do exist abroad but they are not the same. For example, there are fiduciaries in Switzerland, but most of them act as asset managers or administer third-party assets without performing these tasks in their own name. Since Italian fiduciaries have specific features, when we refer to fiduciaries abroad and want to be clear that they are different, we refer to a French, or another, type of fiduciary. However, when referring to Italian fiduciaries, the important difference is that the assets are held in the name of the fiduciary but beneficial ownership remains with the titular owner; whereas, in non-Italian fiduciaries, ownership passes to the trustee or to the trust. This is the big difference. In essence, the titular owner - i.e. the fiduciary or policyholder - remains the beneficial owner of its assets, and the fiduciary therefore acts as a tax withholding agent, as described above.

4/ Why do insurance policies and fiduciaries work well together?

A fiduciary may hold various types of assets on behalf of its clients. In recent years, clients have frequently used fiduciaries to subscribe to insurance policies. Why is this? Because although the client or trustee can easily register the policy in his own name, the tax return obligations and the execution of transactions under the insurance policy must be made directly by the client or trustee. This involves additional obligations and declarations to be made in one’s own tax return, as well as external declarations. The use of a fiduciary enables the client to be free of all these obligations, since it is the fiduciary which, on the client’s behalf, is responsible for monitoring tax compliance and for any payments of tax in the event that the policy is not double-opted or single-opted.

5/ Why are clients interested in subscribing to policies through a fiduciary?

There are various reasons, but no single explanation, as to why a client may decide to subscribe to a policy through a fiduciary. Certainly, what we can say a priori in order to make it more clearly understood, is that the main motivation is confidentiality. Confidentiality which may be expressed in many ways. All the transactions which a client may want to do, or can do, with a life insurance policy can be done through a fiduciary. Thus, the policyholder may appoint his/her own beneficiaries and may decide to change the shares of beneficiaries, or request that everything pass through the fiduciary, and therefore acts as a vehicle through which this kind of information is transmitted; and, when it seeks redemptions, these obviously transit through the fiduciary which settles any tax which may be due. This is one of the main reasons why fiduciaries are used when subscribing to an insurance policy. And there may well be many different reasons.

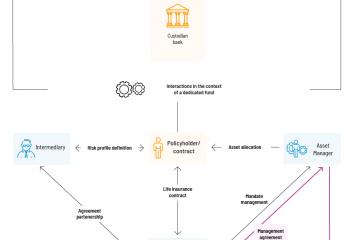

An Italian fiduciary is a typically Italian brokerage company that acts as an intermediary in the underwriting of a life insurance policy. It may pay taxes on behalf of the client in its own name, in which case it is referred to as a withholding agent. The interest of the trust is also that the Luxembourg life insurance policyholder benefits from the anonymity by carrying out his transactions under the cover of the fiduciary."